- Three Forms for Foreign Corporations Entering Japan: Representative Offices, Branches, and Subsidiaries (GK, KK)

- Why is a GK preferable to a KK? Explaining the Advantages and Disadvantages

- The Structure of a 100% Parent Company-Owned LLC

- Points to Note When a Corporation Becomes a Member, Appointment of Executive Officers

- Required Documents

① When foreign corporations enter the Japanese market, their structures are primarily divided into the following three types:Representative offices, branches, and regional offices.

This article outlines the differences between these three structures and provides a detailed explanation of the increasingly common LLC branch office structure ( ).

To summarize the differences between the three structures, they have the following characteristics:

〇 Representative Office

Positioned as an information-gathering office for market research, information collection, advertising, etc., to prepare for future market entry (cannot conduct sales or transactions)

- Legal Entity: None

- Capital: None

〇 Branch

Nature/Role: Decision-making authority resides with the overseas headquarters. Functions as a Japanese base continuously conducting business activities and transactions within Japan as an extension of that headquarters.

- Legal Entity: None (Registered as part of the overseas headquarters) Requires a representative residing in Japan

- Capital: None (Note: Corporate resident tax is levied based on the overseas headquarters’ capital amount)

〇 Subsidiary

Positioned as a company established in Japan with independent legal status from the overseas headquarters, rooted in Japan to conduct business activities and transactions.

- Legal Entity: Yes (treated as a separate Japanese corporation distinct from the foreign headquarters)

- Capital: Required

If it’s unclear whether entering the Japanese market will be successful, a prudent approach is to first establish a representative office to conduct market research. If the business appears promising, then proceed to establish a branch or subsidiary. However, if you already have established business partners or customers require transactions with a company possessing legal entity status in Japan, we recommend establishing a branch or subsidiary from the outset.

Characteristic ① of a Branch Office:

Above all, the overseas headquarters retains decision-making authority. If you are a one-man president who doesn’t want to delegate operational decisions to the Japanese side and insists on the headquarters deciding everything, this is likely the most satisfactory structure. The registration procedures for establishment are extremely simple, and no capital preparation is required.

Branch Feature 2:

However, corporate resident tax is levied in Japan based on the overseas parent company’s capital amount. If the overseas parent company’s capital is substantial (e.g., 100 million yen or more), be aware that the annual corporate resident tax burden will also be significant.

Branch Feature 3:

Since the branch’s tax processing can be consolidated with the overseas headquarters, communication with the headquarters’ accounting staff in a foreign language is expected. Finding a tax accountant capable of handling this can be challenging. Depending on the industry, withholding tax may also apply, tending to complicate accounting.

Recommendation:

Therefore, considering the simplicity of post-establishment operations, our firm recommends establishing a branch office (either a Corporation or a Limited Liability Company).

When establishing a branch office, the first decision is whether to choose a Corporation (Kabushiki Kaisha) or a Limited Liability Company (Godo Kaisha). We will explain the characteristics of each and key points to consider during establishment.

② I want to establish a Japanese “branch office.” Which structure is better: a limited liability company or a corporation?

When establishing a “branch office” in Japan, the first decision is whether to form a “Kabushiki Kaisha (KK)” or a “Godo Kaisha (GK)”. It’s no exaggeration to say that most Japanese companies fall into one of these two categories.

Ⓐ Kabushiki Kaisha

The “Kabushiki Kaisha” structure is familiar in Japan and is so deeply ingrained that it is often referred to simply as “Kabushiki Kaisha” when discussing company types.Its advantages include high credibility and the ability to separate shareholders (company owners) from management, making it easier to raise funds from various investors like angel investors and venture capitalists.

On the downside, establishment costs are high, with articles of incorporation certification fees ranging from ¥30,000 to ¥50,000 and registration license taxes alone costing at least ¥150,000.

Additionally, directors have fixed terms, requiring operational costs for director change registrations, and annual financial statement disclosures add administrative burden.

Ⓑ limited liability company (LLC)

A limited liability company (LLC) is a corporate structure that became available for formation in Japan starting in 2005. In recent years, its popularity has gradually increased as subsidiaries of well-known foreign companies like Amazon and Apple have chosen the LLC structure over the traditional joint-stock company (kabushiki kaisha).

LLCs have low establishment costs, with a minimum registration tax of 60,000 yen, and do not require notarization of articles of incorporation.

Additionally, they have no fixed term for officers, eliminating the cost of officer change registrations and keeping operational costs low.Financial statement disclosure ( ) is also unnecessary, reducing the hassle at year-end.

Back in 2005, LLCs suffered from negative perceptions like “low recognition,” “What even is an LLC?”, and “The title ‘representative member’ sounds uncool compared to ‘representative director’.” However, as major foreign companies like Amazon and Apple chose LLC structures for their Japanese subsidiaries instead of corporations, LLCs gradually gained recognition.

Incidentally, according to Tokyo Shoko Research data, LLCs accounted for 40,655 of the 153,405 new corporations established in 2024, representing 26.5% of all new entities.

Below is a summary of the characteristics of Kabushiki Kaisha (K.K.) and Goudou Kaisha (G.K.), along with the costs associated with their establishment.

≪Corporations and Limited Liability Companies≫

| Kabushiki Kaisha (K.K.) | Limited Liability Company | |

|---|---|---|

| Investors | One or more | |

| Capital Contribution | ¥1 or more | |

| Officers | One or more directors, etc. | Investors

*It is also possible to designate an executive partner |

| Term of Office for Officers | Maximum 10 years

※Re-election required |

None |

| Decision-making body | Shareholders’ Meeting | Investors |

| Executive body | Directors/Board of Directors | Investors

※It is also possible to specify the executive partner |

| Financial Statement Disclosure | Required | Not required |

| Legal Regulations | Numerous | Articles of Incorporation Autonomy (Freely Determinable) |

| Profit/Distribution, etc. | Proportional to investment amount | Free allocation of profits and authority |

| Running Costs | ● High

Obligation to Announce Financial Results: Required Registration fees: Required each time |

● Low

Obligation to Announce Financial Results: None Registration fees: Can be reduced |

| External | High recognition | Low recognition |

≪Comparison of Establishment Costs≫

| Establishing a Corporation | Establishing a Limited Liability Company | |||

|---|---|---|---|---|

| Paper Articles of Incorporation | Electronic Articles of Incorporation | Paper Articles of Incorporation | Electronic Articles of Incorporation | |

| Revenue Stamp | ¥40,000 | ¥0 | ¥40,000 | ¥0 |

| Articles of Incorporation Authentication Fee | ※¥30,000 to ¥50,000 | ※¥30,000 to ¥50,000 | ― | ― |

| Registration Tax | ¥150,000 | ¥150,000 | ¥60,000 | ¥60,000 |

| Total | ¥240,000 | ¥200,000 | ¥100,000 | ¥60,000 |

※For corporations, the Articles of Incorporation certification fee varies based on the company’s capital amount. For capital under ¥1,000,000: ¥30,000; for capital between ¥1,000,000 and under ¥3,000,000: ¥40,000; for capital ¥3,000,000 or more: ¥50,000. (※May be reduced to ¥15,000 depending on the term design. )

Whether to choose KK or GK depends on your business activities, officer structure, etc. Both KK and GK can be established with 100% investment from an overseas parent company. However, KKs have provisions for directors and shareholders’ meetings, requiring shareholder meetings for decision-making, which tends to make operations more complex.

Therefore, we will explain the establishment of a subsidiary in the form of a limited liability company, which has seen increasing requests in recent years.

③ Establishing a “Subsidiary” as a Limited Liability Company

Recently, there has been an increase in establishing branch offices as LLCs, which offer low establishment costs, eliminate the need for shareholder meetings, and enable swift decision-making.

In a LLC, both decision-making and business operations are handled by the investors. Therefore, if an overseas parent company becomes the 100% owner, company decisions can be finalized by investor agreement, eliminating the need for cumbersome procedures like shareholder meetings. If you desire simple and agile operations, a LLC (GK) is more suitable.

Now, let’s explain the structure of a limited liability company wholly owned by an overseas parent company.

① Structure of a 100% Foreign-Owned LLC

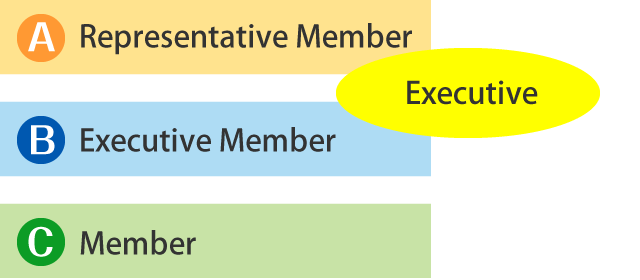

A key characteristic of a limited liability company is that the investors and managers are essentially one and the same. These investor-managers are called “members.” The members of a limited liability company are structured in the following three tiers.

〈Figure 1〉

In principle, all members have the right to represent the company (A. Representative Member) and all members have the right to execute business (B. Executive Member).

Therefore, when an overseas headquarters becomes the sole member, this overseas headquarters is a member, an executive member, and a representative member.

It cannot assume just one of these roles. The position of representative member corresponds to the position of representative director in a joint-stock company.(Note: A corporation cannot be the representative director of a stock company , but it can be the representative member of a limited liability company.)

When an overseas headquarters (a corporation) becomes the representative member, it is important to note that a corporate entity (a company) is not a human being.

Therefore, it cannot physically visit clients to sign contracts, give instructions to employees, or conduct external negotiations.

Since only humans can perform business operations, a person must be appointed to execute business on behalf of the company.

This person is called the “person in charge of duties.”In a limited liability company, even if the representative authority lies with the overseas parent company (corporation), the actual business operations are conducted by the officer.

The structure of a wholly-owned subsidiary LLC is shown in Figure ②.

〈Figure 2〉

Next, let’s touch on points to note when an overseas headquarters becomes a member.

② Points to Note When an Overseas Parent Company Becomes a Member: Appointment of Executive Officers

There are two main issues overseas headquarters face when establishing a branch office.

②―1:

The first is the remittance of capital. The overseas headquarters, as the representative shareholder, must remit the capital before applying for registration of the Japanese branch.

This requires depositing or transferring the capital into a bank account within Japan, even though a corporate account has not yet been opened.

In most cases where the overseas headquarters invests, it does not hold a bank account in Japan.

Therefore, either a Japan-based executive officer must be appointed to receive the funds into their personal account, or if the executive officer resides overseas, a Japan-based third party’s personal account must be borrowed to receive the capital transfer.

Regardless of whether the capital amount is small or large, a “trusted partner” is essential to receive and hold the company’s funds securely.

It is advisable for both companies to sign a contract or agreement before the transfer.

②―2:

The second issue is opening a corporate bank account. While it is legally possible to establish a branch office of a limited liability company with only one overseas parent company, the reality is that without a resident executive officer in Japan, opening a corporate bank account after establishment is nearly impossible.

While opening a corporate bank account is not strictly necessary for business operations, using a personal account for transactions carries a significant disadvantage: it makes it difficult to gain the trust of business partners.

Furthermore, if business transactions are frequently conducted through a personal account, the bank may suspect the account is being used for business purposes and could freeze it.

To overcome these issues, we recommend appointing a resident officer in Japan and opening a corporate bank account.

Finally, regarding the required documents for a branch office of a limited liability company (LLC).

② The major difference between the required documents for a GK branch office and those for establishing a Japanese LLC is the necessity of a certified affidavit.

≪Documents for Establishing a GK Branch Office≫

| Re | Required Documents |

|---|---|

| □ | Articles of Incorporation |

| □ | Certificate of Capital Payment |

| □ | Resolution |

| □ | Letter of Acceptance |

| □ | Seal (Change of Seal) Notification Form |

| □ | Seal Card Issuance Application |

| □ | Affidavit from Overseas Headquarters |

The above explains the establishment of a GK branch office. To summarize, establishing a GK branch office requires appointing an officer, making the selection of personnel crucial.

Furthermore, submission of an Affidavit, a document unfamiliar in Japan, is required, and its preparation necessitates specialized knowledge.

Furthermore, opening a corporate bank account, essential for business activities in Japan, faces increasingly stringent screening each year.

We welcome inquiries from those wishing to expedite the establishment of a GK branch office. Please feel free to contact us by phone or email for consultation.